36+ Financial leverage calculator online

To use this online calculator for Degree of Financial Leverage enter Earnings Before Interest and Taxes EBIT Interest I and hit the calculate button. Financial Leverage Ratio Calculator.

Tm2119232d5 Ex99 1img067 Jpg

However John had to lend some money 400000 from the bank to gather enough money for his plan.

. Margin - how much margin do you wish to use for the trade. Degree of Operating Leverage DOL shows how sensitive is operating income to changes in sales. Here is how the Degree of Financial Leverage calculation can be explained with given input values - 1000016 450000 450000-7.

Account currency - your account deposit currency. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. This 110 is equal to the original principal of 100 plus 10 in interest.

The firms gross margin is 60 and fixed costs are 3 million. Best Web Hosting Picks. For every trade you take there are two components your margin capital and the leverage.

Without knowing the margin requirement at different leverage ratios you might be throwing your entire account on one single position and if you are. Degree of Total Leverage DTL shows sensitivity of the cash flows to owners to changes in revenue. A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily.

A firm has annual sales of 8 million. Best Managed WooCommerce Hosting For Your Online Business. Build Your Future With a Firm that has 85 Years of Investment Experience.

The financial leverage ratio needs to be as low as possible and if it is higher the firm might pretty soon meet the risk of bankruptcy. Earnings Per Share is referred to as EPS. Find a Financial Advisor.

110 is the future value of 100 invested for one year at 10 meaning that 100 today is worth 110 in one year given that the interest rate is 10. A crypto leverage calculator is a tool that is used to calculate how much margin collateral or capital is needed to open your position. Ad Edward Jones Offers Insight on Reliable Investments.

The level of financial leverage is calculated using the formula below. Searching for Financial Security. Financial Leverage Ratio Calculator Debt to Equity Ratio.

The financial leverage ratio of Johns scenario is quite high and risky because his debt is excessive and the total equity ratio is so low. Currency pair - the currency youre trading. Explanation of the Financial Leverage.

Degree of Financial Leverage. Explanation of Financial Leverage Formula. Calculate how much debt and shareholders equity to finance companys assets using financial leverage ratio calculator.

Here is a quick demonstration of how to separate these two factors. Our Financial Advisors Offer a Wealth of Knowledge. The companys DFL is calculated as follows.

One of the most important aspects of risk management in leveraged trading is to be able to calculate your own margin requirement for each position you open in forex stocks and commodity trading. So the total assets equal 550000 in cash. Enter the total debt and shareholders equity in the below online financial leverage calculator and click calculate button to find the output.

The formula to calculate financial leverage is calculated by. The firms annual interest expenses are 100000. It is also known as Debt to equity ratio.

Trade size - contract size or number of traded. The Best Website Builders. Margin capital Your own deposited money.

EPS Change in Percentage Percentage Degree of Financial Leverage EBIT variation. The answer is 110 FV. DFL 8-32-3 8-22-3-01.

The ratio assesses how much capital comes in the form of debts or loans. A leverage ratio is used to measure a companys mix of operating costs giving an idea of how. How much will there be in one year.

If we increase EBIT by 25 how much will the companys EPS increase. Financial Leverage Formula works on the saying that the higher the ratio of debt to equity greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company more financing decisions are taken through debt financing and lesser weighted is given to equity funding which results. Financial Leverage Ratio frac 550000 150000 366.

The Best VPS Web Hosting Services in Australia. The Financial Leverage Formula is used when information from more than one fiscal year of a firm is supplied. The Leverage ratio is a financial measure of a companys ability to meet its future financial needs.

Degree of Financial Leverage DFL shows how sensitive are cash flows available to owners to changes in operating income.

How To Build An Excel Model For Income Tax Brackets Quora

2

Tm2119232d5 Ex99 1img014 Jpg

How To Build An Excel Model For Income Tax Brackets Quora

Am I Too Old For A Full Time Mba Fxmbaconsulting

Tm2119232d5 Ex99 1img036 Jpg

36 Best Online Power Bi Courses By Ed2go Coursera Udemy

How To Build An Excel Model For Income Tax Brackets Quora

Marketing Infographic Calculate Your Marketing Budget For Your Business With This Infographic Marketing Marketing Budget Budgeting Infographic Marketing

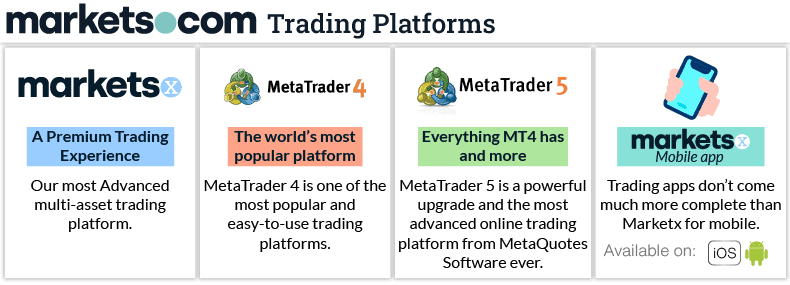

Best Mt5 Broker Comparison Free Fx Broker Fee Calculator

Best Mt5 Broker Comparison Free Fx Broker Fee Calculator

Wacc Calculation Finance Investing Finance Lessons Financial Management

Sec Filing Roivant Sciences Ltd

12 Best Fmva Courses With Practical Training Iim Skills

Tm2119232d5 Ex99 1img031 Jpg

Tm2119232d5 Ex99 1img062 Jpg

Financial Management Formulas Part 1 Financial Management Finance Investing Financial Accounting